Freelancers and agency owners in Pakistan find receiving payment from clients more difficult than obtaining orders. This problem can significantly affect their financial stability and strain their business operations.

PayPal is unavailable in some countries, including Pakistan, due to several factors, such as Government regulations. Some countries have strict rules on money transfers, making it difficult to use online payment services like PayPal. Therefore, PayPal may not be allowed to operate in certain countries.

One possible reason why PayPal is not available could be Pakistan’s lack of demand for PayPal services.

In this article, we will explore various practical techniques that can benefit both freelancers and agency owners. These methods have been thoughtfully selected to help individuals excel in their professions.

Stripe

Stripe has expanded its services to many countries, but Pakistan is not one of those with full, direct support yet.

Although Stripe’s standard payment processing is not directly available in Pakistan, there is a way to accept Stripe payments. This can be done by creating a Fiverr Workspace account, which allows for Stripe integration. To set this up, you can use international bank account information, such as the details provided by Payoneer’s international bank feature.

This enables you to process payments through Stripe, with the funds being transferred to your designated bank account afterward. Additionally, Stripe supports Pakistani phone numbers, which allows users to complete account verification.

Remitly

For those who work as freelancers or have clients who pay monthly fees, Remitly is an excellent choice. This money transfer service offers users the added benefit of receiving their first transfer completely free of charge.

How to Send Money to Pakistan With Remitly

To get started, please create an account with your email address. Once you’ve signed up, enter the amount and recipient details, choose the delivery and payment method, and transfer funds securely and conveniently.

Transparent and Cost-Efficient Money Transfers

Experience reliable rates with no hidden charges. Pay no fees on your initial transfer or transfers of £200 or more in the future. You can depend on us to deliver your transfers on schedule, or we’ll refund your fees.

Remitly Money Transfer Options for Pakistan

It provides various platforms to receive payments in Pakistan, including;

Payoneer

Payoneer is a viable option for Pakistani freelancers looking to receive global payments. It is a well-known choice among freelancers using platforms like Fiverr or Upwork.

However, there are some limitations for those who use Payoneer. Clients must have a Payoneer account to send payments, which can be a drawback.

Payoneer offers two methods for receiving payments: 1) requesting payments from registered Payoneer users, and 2) using receiving accounts to accept local bank transfers in various currencies.

However, you cannot receive funds directly from an individual’s local bank account to your Payoneer bank account. Instead, you can use your Payoneer account to receive payments from business accounts such as Amazon, the Impact affiliate platform, Stripe, PayPal, and other internationally recognized businesses that facilitate local bank transfers.

However, there is an alternative way to receive payment from clients without requiring them to register.

Method 1 – Registered Accounts

Go to the ‘Request a Payment’ section, choose your payer, and either select the client you’re billing or add them as a new payer.

Include essential invoice details such as payment amount, currency, due date, and goods/services description. You can attach up to five documents to each invoice.

Create an invoice, preview it, generate a PDF, and attach it to an email directly from your Payoneer account.

Your client will receive an email notification once you submit a payment request through Payoneer. Your client must then choose a password and select their preferred payment method.

After you make the payment, the funds will be transferred to your Payoneer account for your use or withdrawal.

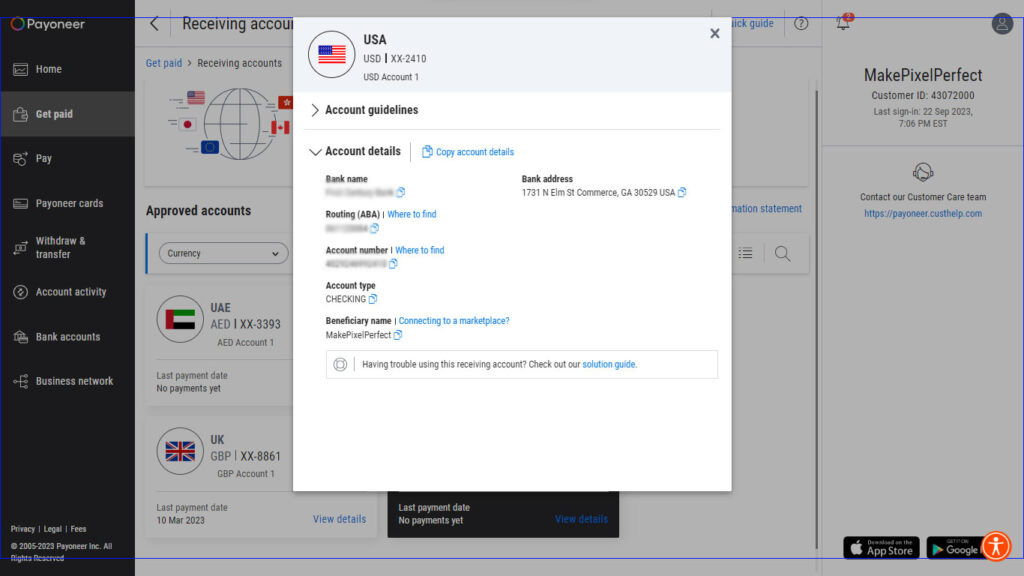

Method 2 – Non-Registered Client Account

Login into the Payoneer dashboard, navigate to Get paid > Receiving accounts > Request accounts.

Using this method, you will get local bank accounts in some of the popular currencies given below.

- USA (USD)

- Canada (CAD)

- UAE (AED)

- UK (GBP)

- Eurozone (EUR)

- Singapore (SGD)

- Japan (JPY)

- Australia (AUD)

This is how you will get bank account details and use them for local bank transfers.

Here are the account guidelines

- Use for local bank transfers within the (Specific Country you request for the bank account, USD, GBP, AED, etc.)

- Payoneer only support payments for business transactions made from business accounts.

- If you attempt to make payments from your personal bank account, they will be declined.

- If payments are made from a bank account under your name, they will be rejected.

- Unfortunately, Payoneer do not support wire transfers.

To request bank accounts from Payoneer, your address must be verified through a Utility Bill, Bank Statement, or other means. For easy verification, entering an address in your Payoneer account that matches the one on your Bank Account statement or Utility bill is essential. Once verified, you can access these international-local banks within a few days.

SadaPay – SadaBiz (No Longer Available Now)

SadaPay has stopped the SadaBiz feature that lets people in Pakistan receive international payments; they are in a loss since they released this feature, and since they stopped this feature, they are upgarding, but it’s been months they haven’t active this feature back.

SadaPay Private Limited was registered with Pakistan’s Securities and Exchange Commission, providing Pakistani freelancers with an additional method for receiving payments from international clients. They used to receive amounts directly into their SadaPay accounts with no hidden fees or huge taxes.

Many freelancers struggled with the burden of high taxes, with up to 20% of their earnings being deducted from the first platform they worked on. This was followed by additional taxes from other platforms and bank exchange rates.

SadaPay is currently offering services like virtual cards and microfinance banking, similar to platforms like EasyPaisa and JazzCash. However, what sets SadaPay apart is that they provide these services at a more affordable rate compared to other virtual debit card providers.

How to Receive Payment Internationally from SadaPay (Not Available Right Now)

Generate a payment link

With just a few clicks on your SadaPay app, you can generate a personalized link for your client.

Distribute the link effortlessly

You can easily share this link with your client through multiple channels, including WhatsApp, email, and SMS.

Receive payments seamlessly

Your client only needs to input their credit card information to finalize the payment, making the process hassle-free.

Register For LLC If You Are Business Owner

If you are a freelancer or an agency owner looking to establish a personal business in the United States, LLC registration might be the way to go. This registration method allows you to register your business with a mailing address and a Mercury account, allowing you to have a presence in the US even if you do not reside there.

With a Mercury account, you can easily manage your money, receive payments, and send invoices. This option is handy for expanding their business operations to the US market.

Registering as an LLC has many benefits. You’ll have limited liability, which protects your assets from business debts. You can manage the company yourself or appoint managers. LLCs offer pass-through taxation, simplifying tax matters and potentially saving money.

Fewer administrative requirements and increased credibility are also advantages. Additionally, it formalizes the separation between personal and business finances.

Multiple options are available for LLC formation, which can help you create accounts with PayPal, Stripe, and Mercury bank accounts to accept international payments.

A: Challenges stem from limited access to global payment platforms like PayPal, due to factors such as government regulations and perceived lack of demand.

A: No, SadaPay has discontinued the SadaBiz feature due to financial losses and feature upgrades.

A: SadaPay is currently undergoing upgrades, and while they have indicated they intend to improve their services, there is no confirmed timeline for the return of a feature like SadaBiz. It has been several months since they stopped the feature.

A: Freelancers should explore alternative payment methods such as Stripe (Indirectly), Payoneer, Remitly, or consider establishing a U.S. LLC with a Mercury account, as outlined in the article.

A: SadaPay continues to offer its standard domestic digital banking services with the cheapest virtual and physical card within Pakistan. It is the international services that have been halted.

A: Yes, they can, by using online legal services, that set up LLC’s

A: An LLC helps protect your personal assets, makes your business look more trustworthy, and makes it easier to open U.S. business bank accounts. It also allows you to use payment services like Stripe and PayPal, which can help you sell to customers around the world.

A: Services like TailorBrands, Privatily, and ZenBusiness assist with LLC formation, EIN filing, and related business services.

A: Payoneer allows you to receive payments in two ways: by requesting payments from registered users or through receiving accounts for local bank transfers in different currencies. You cannot receive funds from an individual’s local bank account directly; however, you can receive payments from business platforms like Amazon, Stripe, and PayPal.